Guideline for Downloading Tax Documents Via IIT App

1. Tax record

2. Tax detail page screenshot

are required to upload for taxed income verification, see samples below.

1.Download Individual Income Tax (个人所得税) app.

Notes:

If you haven't registered your account in the app, you will need to obtain the tax registration code.

There are two ways to get it:

-

Go to the tax service bureau in person

Required material: passport.

(If you encounter any language barriers, feel free to call the Guangzhou Multilingual Public Service Platform Hotline at 020-960169 for government-supported real-time translation services. The platform will not charge any service fee.)

-

Authorize someone else or other agency

If you don't have time to go to the tax bureau, you can ask your friend or other agency to do it.

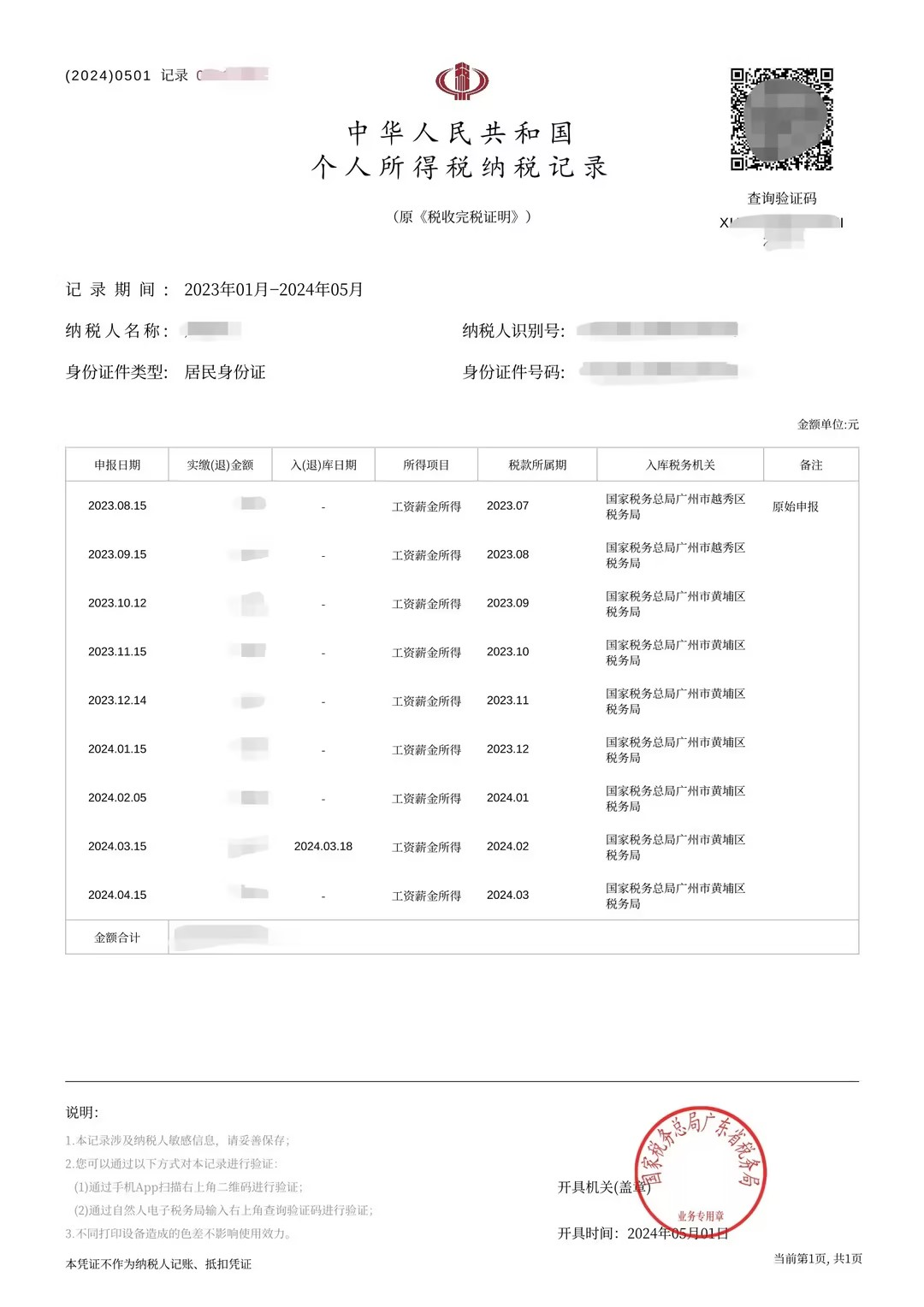

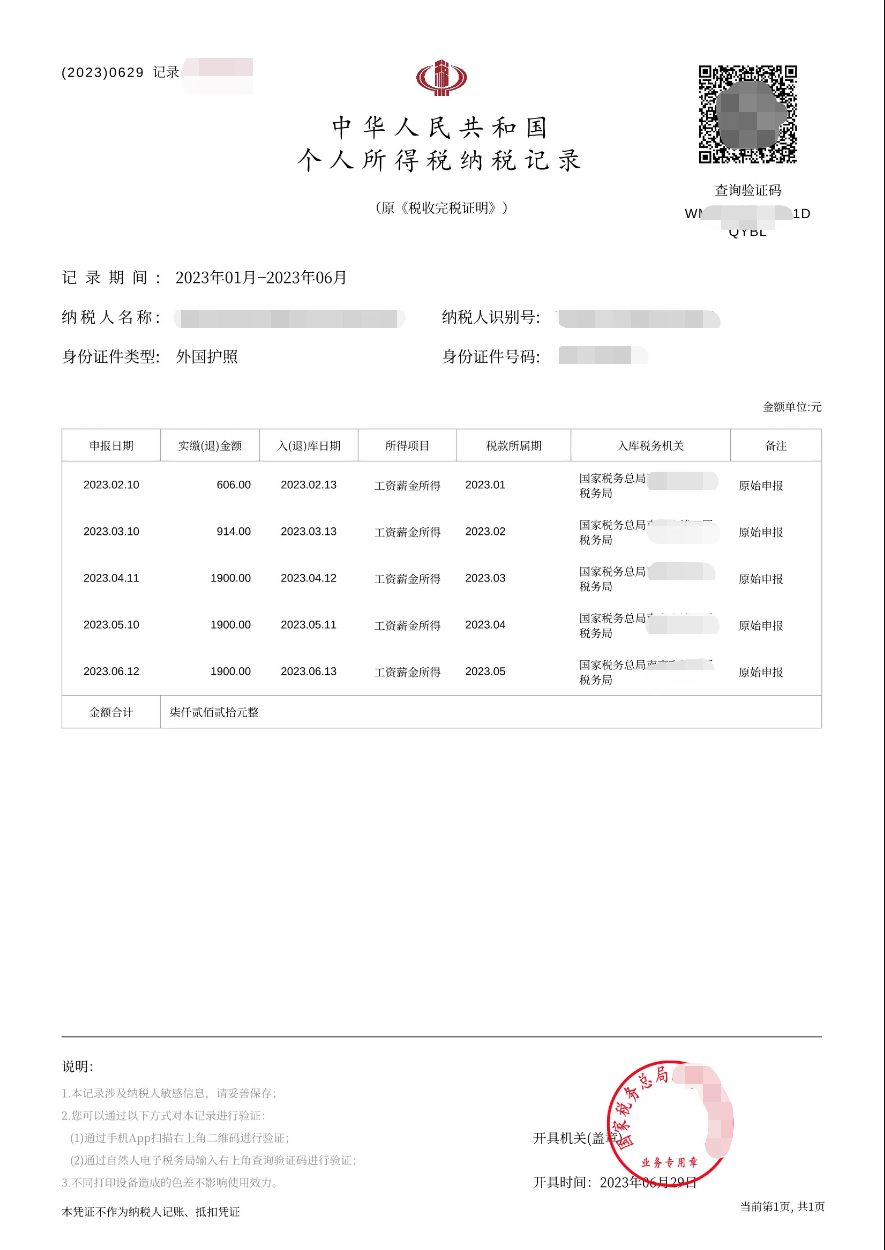

Tax record sample

Tax records can generate transfer limits based on your annual income.

Step 1: Click 纳税记录开具 (Certificate Issuance-Tax Record Issuance). on the main page.

Step 2: Select the period for which you would like to obtain a tax record. You can choose the longest period possible. Then click on 生成纳税记录 (Generate Tax Record).

Step 3: Click 保存 (Save) and your tax records will be saved as an image to your photo album, upload the right one to SkyRemit.

How to Get Tax Details?

Tax detail page sample

As tax records may not accurately reflect your actual income, we kindly request that you provide screenshots of your tax details as proof of income.

Step 1: Click 收入纳税明细查询 (Income Tax Details Inquiry);

Step 2: Select the year and click 查询 (Inquiry).

Step 3: Capture a screenshot of the left below page (收入纳税明细), and ensure that the date period matches the tax records you have downloaded.

If you cannot get the tax documents via the IIT app, you can also get them from your HR.